https://www3.nhk.or.jp/news/html/20220420/k10013590231000.html

https://www3.nhk.or.jp/news/html/20220420/k10013590231000.html

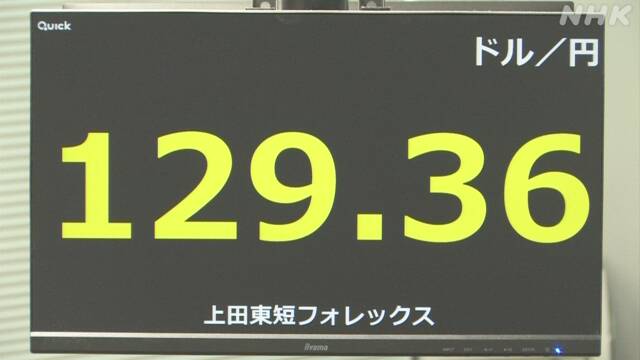

Yen exchange rate Temporary 1 dollar = 129 Yen level First half of 20 years Yen depreciation level

In the Tokyo foreign exchange market on the 20th

of April, the yen was sold, and the dollar was bought against the backdrop of

the widening interest rate differential between Japan and the United States.

The price has dropped to the first half of the yen.

The yen exchange rate is in the overseas market on the

morning of 20th of April, and from the view that the interest rate

differential between Japan and the United States will widen due to the rise in

long-term interest rates in the United States, the movement to buy dollars with

higher yields and sell yen has intensified, and 1 dollar = 129-yen, The price

fell to the yen level, the lowest level in 20 years since April 2002.

In response to this trend, the yen depreciated to the low 129-yen

level at one point in the Tokyo foreign exchange market.

Market officials announced that the Bank of Japan would

implement a measure called a limit operation to borrow unlimited government

bonds at a specified yield to curb the rise in long-term interest rates.

Deputy

Chief Cabinet Secretary Isozaki "I want to watch with a sense of

tension."

At a press conference, Deputy Chief Cabinet Secretary

Isozaki said, “We have traditionally refrained from commenting on market

levels, but we believe that foreign exchange stability is extremely important

and that rapid fluctuations are not particularly desirable. I would like to pay

close attention to the trends in the foreign exchange market and the impact on

the Japanese economy, including the recent depreciation of the yen.”

He added, “Forex policy is based on the idea agreed upon by

the G7 = seven major countries, and we would like to take appropriate measures

as the government while maintaining close communication with the monetary

authorities such as the United States.”

Source: https://www3.nhk.or.jp/news/html/20220420/k10013590231000.html

English

English Japan

Japan