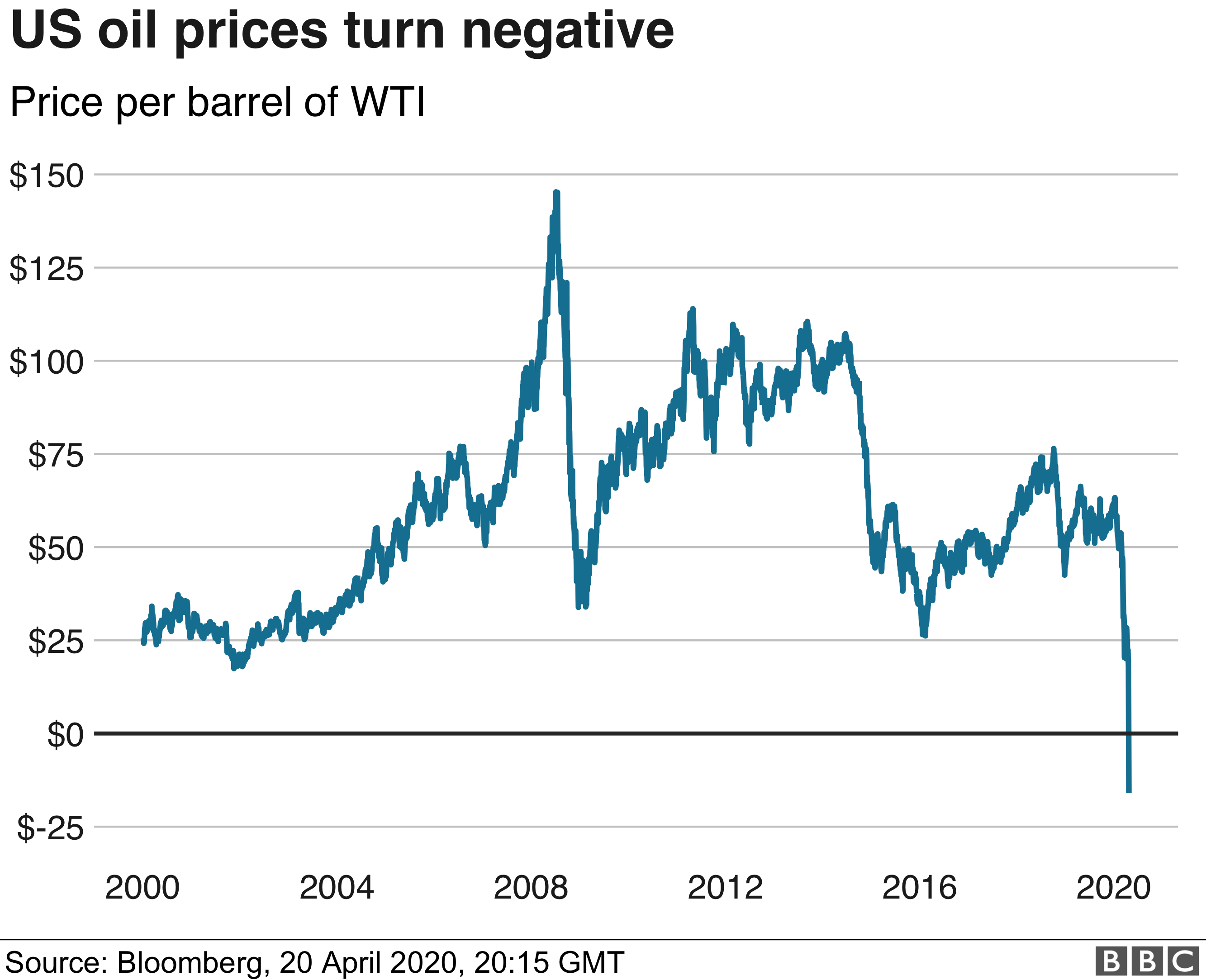

US Oil Price Turn Negative

US Oil Price Turn Negative

Oil prices collapse as coronavirus demand

The coronavirus pandemic has caused oil price drop rapidly. For the first time in history, the oil prices of US oil has turned negative. This issue got the double shock by Saudi-Rusia price war.

The issue of price war has caused oil prices to collapse to levels that make it impossible for US shale oil companies to make money. US crude for May delivery turned negative on Monday -- something that has never happened since NYMEX oil futures began trading in 1983. It was easily the oil market's worst day on record (cnn).

That means oil producers are paying buyers to take the commodity off their hands over fears that storage capacity could run out in May.Demand for oil has all but dried up as lockdowns across the world have kept people inside.

Many oil companies took on too much debt during the good times. Some of them won't be able to survive this historic downturn. As a result, oil firms have resorted to renting tankers to store the surplus supply and that has forced the price of US oil into negative territory.

The severe drop on Monday was driven in part by a technicality of the global oil market. The dire outlook in the oil industry will make it very difficult for companies attempting to reorganize in Chapter 11 proceedings to get the required financing and support. Debtholders who would normally swap their debt for equity may not want that equity.

That means, unlike the 2014-2016 crash,

some oil companies may not survive altogether.

Source: http://tiny.cc/v6ignz

English

English Japan

Japan

professional samples of baby products 2 viagra in one day viagra side effects more than or more than cialis 10 mg daily use online doctors prescriptions for pain

furosemide hypertension furosemide 80 mg torsemide vs furosemide in kidney failure what is lasix high dose

azithromycin expiration drug azithromycin 500 mg can i drink while on azithromycin what is azithromycin for

canadian pharmacy discount code - canadian vet pharmacy reliable canadian pharmacy reviews

provigil headaches provigil buy over the counter does modafinil cause weight gain how much is provigil at walmart with insurance

ibuprofen with prednisone prednisone price in india does prednisone help break up mucus how long does it take for prednisone to leave your body

tadalafil daily - 20mg cialis versus 2.5mg cialis best viagra pills in india

sildenafil pfizer 50 mg price alternative to viagra ed over the counter cvs tylenol samples for doctors office female viagra pill best erectile dysfunction pills printable pink ladies logo cialis daily use insurance gnc instant pill for impotence viagra sildenafil viagra fastest us delivery direct pharmacy usa cialis viagra plus 400 mg viagra dosage women viagra amazon generic viagra us pharmacy cenforce 200 side effects sunscreen samples for physician offices side effects of viagra warnings for viagra aleve samples for physicians viagra no prescription teva pharmaceuticals viagra generic ed medication price comparison over the counter ed pill viagra tablet how to take levitra generic viagra picture of pill over counter substitute for viagra viagra alternatives men's sexual health supplements sildenafil citrate 25mg tablets

875 mg amoxicillin amoxil 500 mg online without prescription amoxicillin childrens dosage

ventolin coupon 2016 ventolin pharmacy is a ventolin inhaler a steroid? how albuterol works

hydroxychloroquine and zithromax where can i buy zithromax what do you take azithromycin for

stromectol cost in usa - ivermectin buy buy oral stromectol

obama provigil cost of modafinil in china provigil who makes this drug test

ventolin copd can i buy ventolin over the counter in nz how often can i use albuterol how to take albuterol

zithromax for flu where can i purchase azithromycin does azithromycin treat strep throat what azithromycin

lilly savings card viagra drug facts viagra para mujer goodrx prescription drugs trulicity in canada how and when to take viagra

furosemide baseball furosemide tablets 40 mg for sale what do furosemide tablets look like what is the common dosage of lasix for asceties

plaquenil hair growth hydroxychloroquine tablets plaquenil for treatment of igg4 related disease what can i take for lupus if i am allergic to plaquenil

hollywood casino online real money - online casino games for real money slot machine games

rite aid erectile dysfunction products tadalafil 20mg lowest price viagra price cvs pharmacy viagra receptfritt cvs coupons 800 mg viagra gold china other benefits of viagra

amoxicillin clav 875 buy amoxicillin 250mg uk amoxicillin dental dosage amoxicillin suspension dosage

amoxicillin sale - amoxil 250mg online kroger amoxicillin price

neurontin seizure neurontin from canada does neurontin go through kidneys what happens when you stop taking gabapentin

water pill lasix lasix 40 mg tablet price furosemide 40mg tablets side effects explains why furosemide is administered to treat hypertension?

accutane by mail - accutane medication accutane 10mg price

penile enlargement options where can i purchase phen375 womens viagra printable viagra coupons walmart eileen henry viagra commercial actress why does viagra cost so much now