Monetary Easing and Foreign Exchange Intervention Have Different Policy Objectives and Are Not Inconsistent: Finance Minister Suzuki

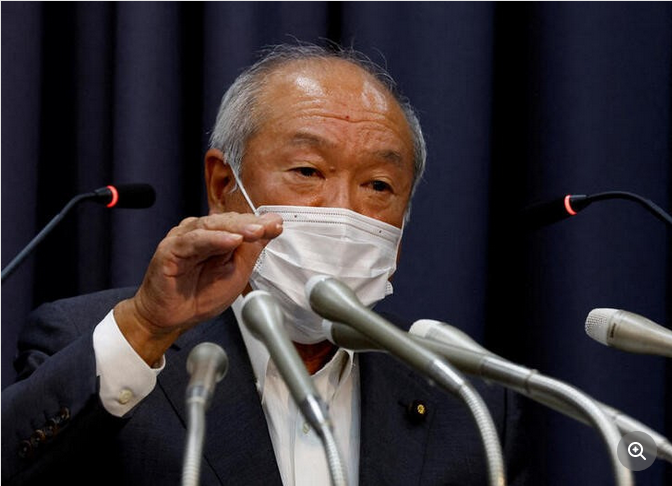

[Tokyo 25th Reuters] - Finance Minister Shunichi Suzuki said on the 25th that the monetary policy of the Bank of Japan, which continues to implement large-scale monetary easing, and the policy objectives of foreign exchange intervention are different and "not inconsistent." He said at a post-cabinet press conference in the morning of the same day.

Finance Minister Suzuki pointed out that the Bank of Japan's monetary policy is being carried out "to achieve the price stability target." On the other hand, with regard to foreign exchange intervention, he explained the difference in policy objectives, saying, "It is done to deal with excessive (exchange) fluctuations." As for monetary policy itself, he said, "We must leave it to the Bank of Japan."

Regarding the exchange rate, he said, "I do not comment on day-to-day currency movements." "Foreign exchange markets move due to various factors. It is difficult to generalize exchange rate movements," he said. He pointed out that "if the rapid fluctuations caused by speculation are left unchecked, it will affect companies and households,'' and added, "Excessive fluctuations due to speculation cannot be tolerated.''

Finance Minister Suzuki reiterated his intention to "appropriately respond" to excessive exchange rate fluctuations, and said that he "consults on a regular basis" with the U.S. currency authorities.

In response to the resignation of Economic Revitalization Minister Daishiro Yamagiwa, he said, "We must ensure that economic measures are not delayed."

Source: https://news.yahoo.co.jp/articles/9a9c24252034e837e6452c759a67fcd4ba8aacba

English

English Japan

Japan