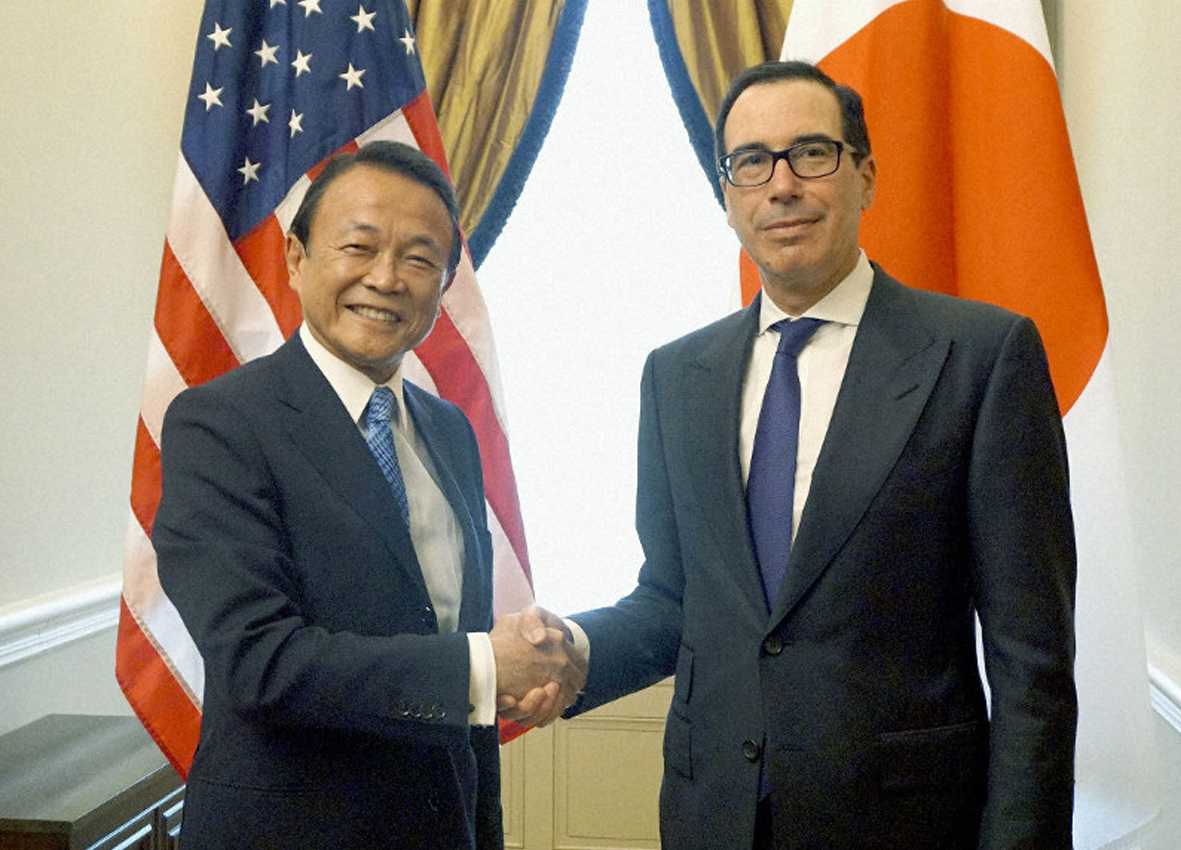

Japan opposes linking currency to trade, Aso tells Mnuchin

WASHINGTON - Finance Minister Taro Aso told U.S. Treasury Secretary Steven Mnuchin on Thursday that Japan opposes linking trade and currency policy, countering Mnuchin's insistence that a provision preventing currency devaluations be included in a trade agreement with Japan.

"I told (Mnuchin) that we don't support discussions that would link trade policy to foreign exchange policy," Aso told reporters after a meeting with Mnuchin in Washington.

The ministers "confirmed their respective positions," Aso said, indicating Mnuchin repeated a call by President Donald Trump's administration for a currency provision in an effort to reduce the U.S. trade deficit with Japan.

The Treasury Department did not say what Mnuchin told Aso. A brief statement said the two "reaffirmed the importance of the U.S.-Japan economic relationship," and that they discussed other key issues including China, North Korea, and Iran sanctions.

In a separate meeting, Japanese economic revitalization minister Toshimitsu Motegi and U.S. Trade Representative Robert Lighthizer discussed cutting tariffs on agricultural and industrial products as part of new negotiations for a bilateral trade agreement.

Motegi said after the meeting in the U.S. capital that he and Lighthizer did not discuss currency issues, and that Lighthizer did not request that Japan set quotas to restrict automobile exports.

The two sets of ministerial talks came a day before Japanese Prime Minister Shinzo Abe and Trump are expected to focus on trade, and North Korea, at a White House meeting.

Referring to the Aso-Mnuchin meeting, a senior Japanese Finance Ministry official said the ministers agreed to discuss how to handle currency issues in relation to bilateral trade negotiations led by Motegi and Lighthizer.

Going forward, the two countries' finance authorities will look at whether to include a currency provision in a Japan-U.S. trade agreement, the official said, requesting anonymity.

Japanese officials have expressed reluctance about such a provision, partly because it could affect the Bank of Japan's monetary policy. It could also restrict Japan from intervening in the currency market to curb excess in volatility and exchange-rate movements.

Japan has 17 trade agreements, but none contains a legally binding currency provision in their main text.

The Trump administration included a currency provision in the revised North American Free Trade Agreement involving Canada and Mexico, and is pushing for such a provision in a trade deal under negotiation with China.

Earlier Thursday, U.S. Ambassador to Japan William Hagerty expressed hope for "rapid progress" in trade negotiations with Japan.

"My hope is that the negotiators will bring things to closure rather quickly," Hagerty told reporters in Washington. "I'm going to look forward to seeing really rapid progress."

During the first round of trade negotiations last week, Motegi and Lighthizer started talks about cutting tariffs on agricultural and industrial products.

They also agreed to start talks on digital trade, an area including e-commerce and music distribution services, at an appropriate time.

Source: https://mainichi.jp/english/articles/20190426/p2g/00m/0bu/037000c

English

English Japan

Japan

insurance accepted by walgreens pharmacy generic pharmacy online india generic drug companies viagra cock cialis at walmart pharmacy trulicity patient reviews

aquaphor samples for doctors office red viagra tablets alternatives for cialis or viagra sales of viagra new fda approved diet pill nugenix daily dosage viagra gum does male enhancement work where to buy androzene online doctors that provide prescriptions viagra tablets cialis instructions for use age for birth control pills the red pill viagra danger myths new viagra pill for women fda dietary supplement tadalafil 20 mg lowest price india viagra para mujer viagra overnight shipping is viagra safe best male enhancement pills at gnc is viagra good for your heart brand viagra coupon for belviq diet pill sildenafil generic 100mg how to decrease libido in women cost of viagra per pill does viagra work immediately viagra jokes one liners viagra users testimonials viagra in india best source for genuine viagra

ed pills over the counter amazon sale items electronic sildenafil 100mg for sale what does viagra do natural remedy for low libido in women contrave before and after

kroger purified bottled water cialis generic prices viagras cvs coupons for prescriptions cvs pharmacy transfer prescription

walgreens pharmacy viagra coupons extra super cialis 100mg viagra pills life is good t shirts list of walgreens pharmacists walmart free coupons for groceries